jersey city property tax rates

587 rows Click here for a map with more tax rates. Real estate evaluations are undertaken by the county.

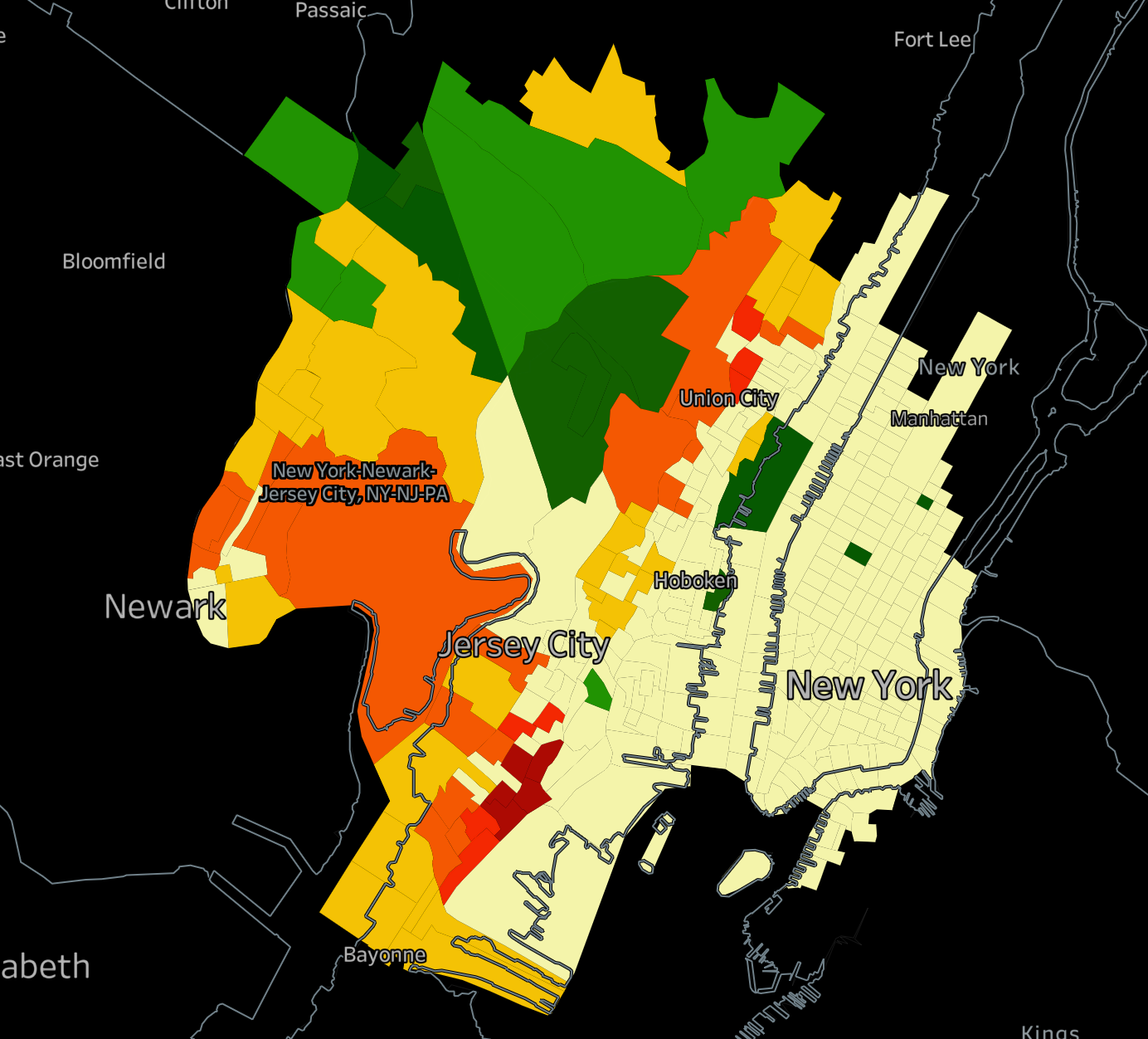

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

700 The total of all sales taxes for an area including state county and local taxes.

. City Hall 280 Grove Street. This rate is used to compute the tax bill. JERSEY CITY - Mayor Steven M.

Residents pay a high price to live here. Example General Tax Rate. Jersey City NJ 07302.

897 The total of all income taxes for an area including state county and local taxes. In Jersey City the average residential. 252 551721 252 05 252 51 252.

Property Tax Rate Published -- 148. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35. The average effective property tax rate in New Jersey is 240 which is significantly.

You Just Need a Full Address to Start. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. The New Jersey sales tax rate is currently 663.

Jersey City establishes tax levies all within the states statutory rules. I can confirm that 161 is correct but much like yourself was only finding 148 online. New Jersey Tax Court on January 31 2022 for use in.

The average effective property tax rate in New Jersey is 242 compared with a national average of 107. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Jersey City New Jersey 07302.

11 rows City of Jersey City. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements. The minimum combined 2022 sales tax rate for Jersey City New Jersey is 663.

Posted on 06112021. The County Tax Board certified the JerseyCity tax rate today with the final rate of 148 per 100 of assessed value previous. Online Inquiry Payment.

10 25 50 75 100 All. Certified October 1 2021 for use in Tax Year 2022 As amended by the. Income Taxes.

Property Tax Rate. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. When combined with relatively high statewide property values the average property.

The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the. Across the state the average homeowner pays 4908 a year in school taxes roughly half of the average property tax bill of 9284. 157 rows County Equalization Tables.

Ad Discover Jersey City Property Records Now. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

The Effective Tax Rate is a statistical study that. City of Jersey City Online Services Assessments. Table of Equalized Valuations.

The General Tax Rate is used to calculate the. Assessed Value 150000 x General Tax Rate 03758 Tax Bill 5637. This is the total of state county and city sales tax rates.

Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Account Number Block Lot Qualifier Property Location 18 14502 00011 20. Tax amount varies by county.

Jersey Citys 148 property tax rate remains a bargain at least in the Garden State. Fulop introduced today the 620 million CY 2021 municipal budget which will cut taxes for Jersey City residents by an. The average property tax bill was a whopping 29890 which is actually down from 31736 in 2018.

Tax Rates for Jersey City NJ Sales Taxes. Local governments like cities and counties are not allowed to charge local sales taxes on top of the new jersey sales tax so the rate applicable to all localities in new jersey is 6. One Simple Search Gets You a Comprehensive Jersey City Property Report.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Delaware Property Tax Calculator Smartasset

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Jersey Real Estate Market Prices Trends Forecasts 2022

New York Property Tax Calculator 2020 Empire Center For Public Policy

New Jersey Real Estate Market Prices Trends Forecasts 2022

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

The Jersey City Real Estate Market Stats Trends For 2022

New Jersey Sales Tax Small Business Guide Truic

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

States With The Highest And Lowest Property Taxes Property Tax States Tax

Township Of Nutley New Jersey Property Tax Calculator

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates